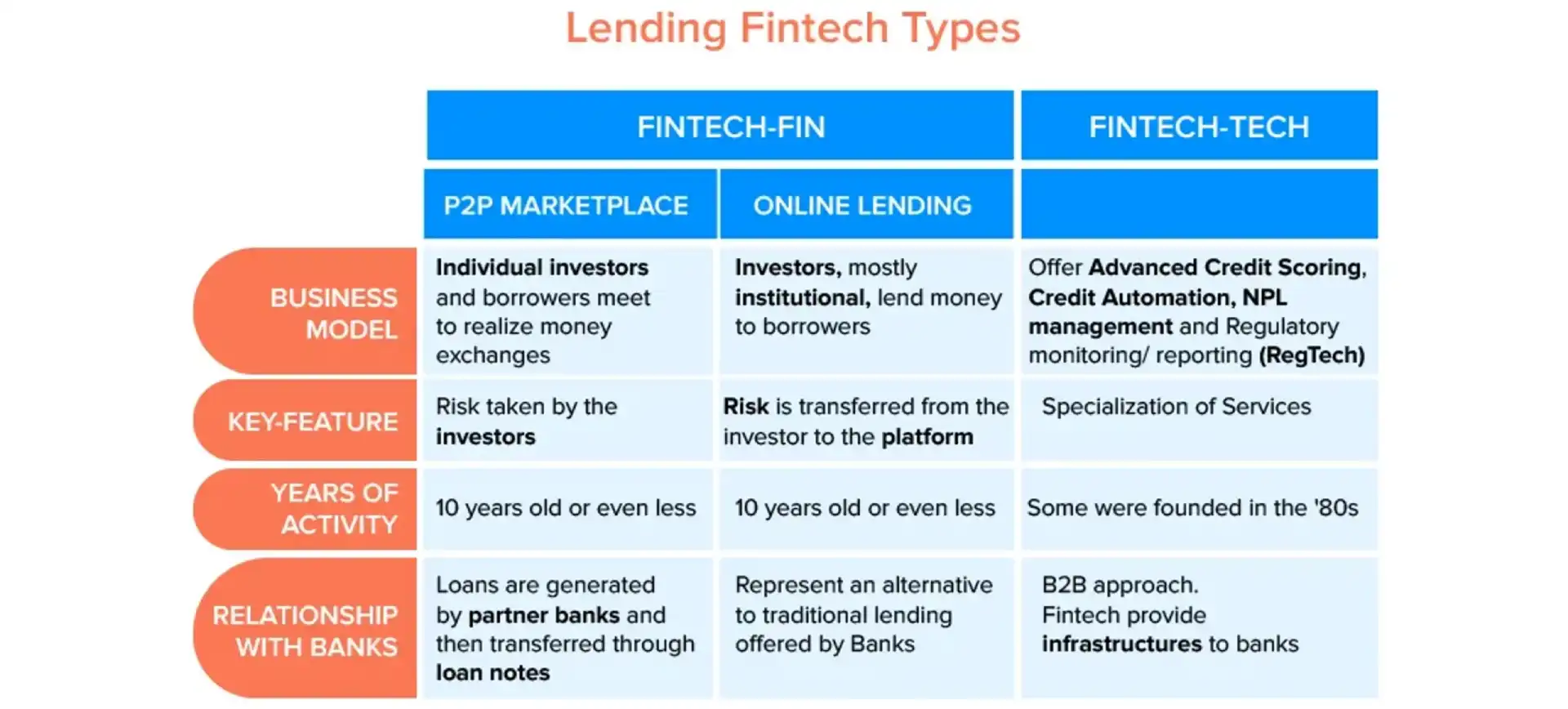

Lending as a Service (LaaS) is a relatively new concept in the lending industry, which has emerged in response to the growing demand for innovative fintech solutions. The history of LaaS can be traced back to the early days of peer-to-peer (P2P) lending platforms, which were one of the first fintech innovations to disrupt the traditional lending industry.

P2P lending platforms, such as Lending Club and Prosper, were founded in the mid-2000s and allowed individuals to lend money directly to other individuals, bypassing traditional banks and financial institutions. While P2P lending platforms offered an innovative alternative to traditional lending, they faced a number of regulatory and operational challenges that limited their growth and scalability.

In response to these challenges, a new generation of fintech companies emerged that focused on providing lending services to businesses through APIs. These companies, which are now known as LaaS providers, offer businesses a range of lending options, including consumer and commercial loans, mortgages, and credit lines.

The first LaaS providers emerged in the early 2010s, and the market has grown rapidly in recent years. Today, LaaS is a rapidly growing segment of the fintech industry, with a wide range of providers offering a variety of lending services to businesses of all sizes.

Overall, the history of LaaS is closely tied to the broader evolution of the fintech industry, which has disrupted traditional financial services by leveraging technology and innovation to offer new and improved solutions to consumers and businesses alike.