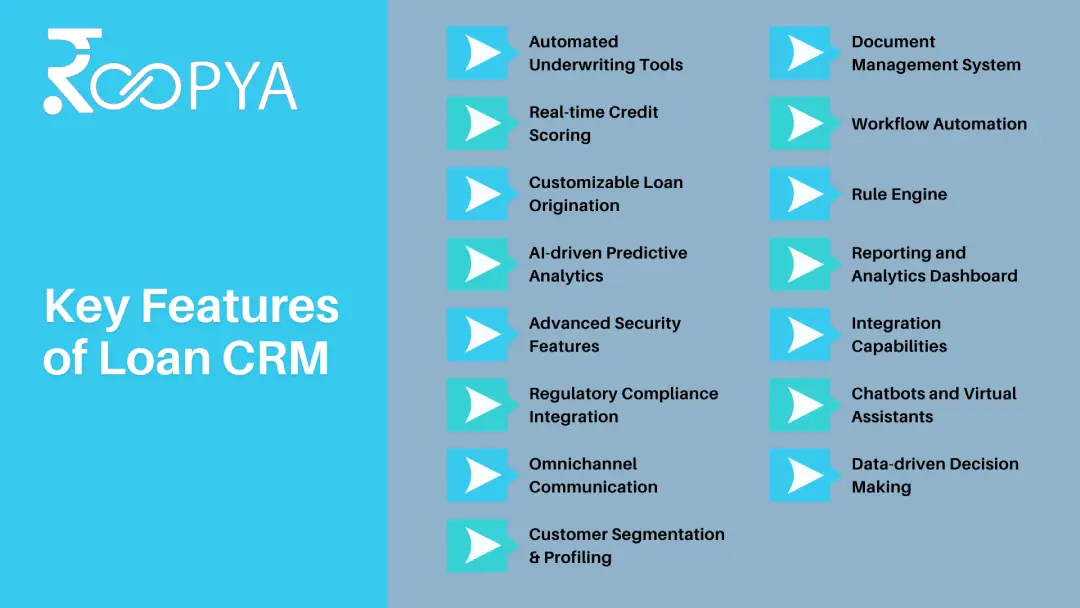

| Automated Underwriting Tools |

Utilizes AI and ML algorithms to automatically assess borrower’s creditworthiness, streamlining the loan approval process by analysing credit reports, income, and other relevant data in real-time. |

| Real-time Credit Scoring |

Integrates with credit bureaus to fetch and update credit scores instantly, aiding in the accurate assessment of loan applications and risk management. |

| Customizable Loan Origination |

Offers flexible workflows that can be tailored to specific loan products or lender requirements, enhancing the efficiency of the loan origination process from application to disbursement. |

| AI-driven Predictive Analytics |

Leverages machine learning models to predict future customer behaviour, loan default probabilities, and market trends, enabling proactive decision-making and personalized loan offerings. |

| Advanced Security Features |

Incorporates encryption, secure access controls, and data protection measures to safeguard sensitive customer information and comply with regulatory standards like GDPR and CCPA. |

| Regulatory Compliance Integration |

Ensures that loan processes adhere to current financial regulations and standards by integrating with regulatory compliance databases and tools, automating compliance checks and reporting. |

| Omnichannel Communication |

Supports seamless communication with customers across multiple channels (email, SMS, phone calls, web portals) for notifications, reminders, and personalized marketing, all tracked within the CRM for a unified view of customer interactions. |

| Customer Segmentation & Profiling |

Utilizes data analytics to segment customers based on behaviour, preferences, and financial history, enabling targeted marketing strategies and customized loan products. |

| Document Management System |

Streamlines the storage, retrieval, and management of loan documents and contracts with digital signatures, making the loan processing more efficient and reducing the reliance on physical documents. |

| Workflow Automation |

Automates routine tasks such as application verification, document requests, and follow-ups, improving operational efficiency and allowing staff to focus on more complex customer service and loan analysis activities. |

| Rule Engine |

A dynamic rule-based engine that allows lenders to configure and automate decision-making processes based on predefined criteria, enabling faster response to market changes and customer needs without extensive IT involvement. |

| Reporting and Analytics Dashboard |

Offers comprehensive reporting tools and dashboards for real-time monitoring of key performance indicators (KPIs), financial metrics, and customer insights, supporting strategic decision-making and performance optimization. |

| Integration Capabilities |

Provides APIs and integration frameworks for seamless connectivity with external banking systems, payment gateways, credit bureaus, and other financial service providers, ensuring a cohesive ecosystem for loan servicing and management. |

| Chatbots and Virtual Assistants |

Employs AI-powered chatbots and virtual assistants for 24/7 customer support, handling inquiries, guiding loan application processes, and providing personalized advice, enhancing customer experience and engagement. |

| Data-driven Decision Making |

Leverages big data analytics for in-depth analysis of customer data, market trends, and loan performance, aiding in the development of data-driven strategies for loan offerings, risk management, and business growth. |