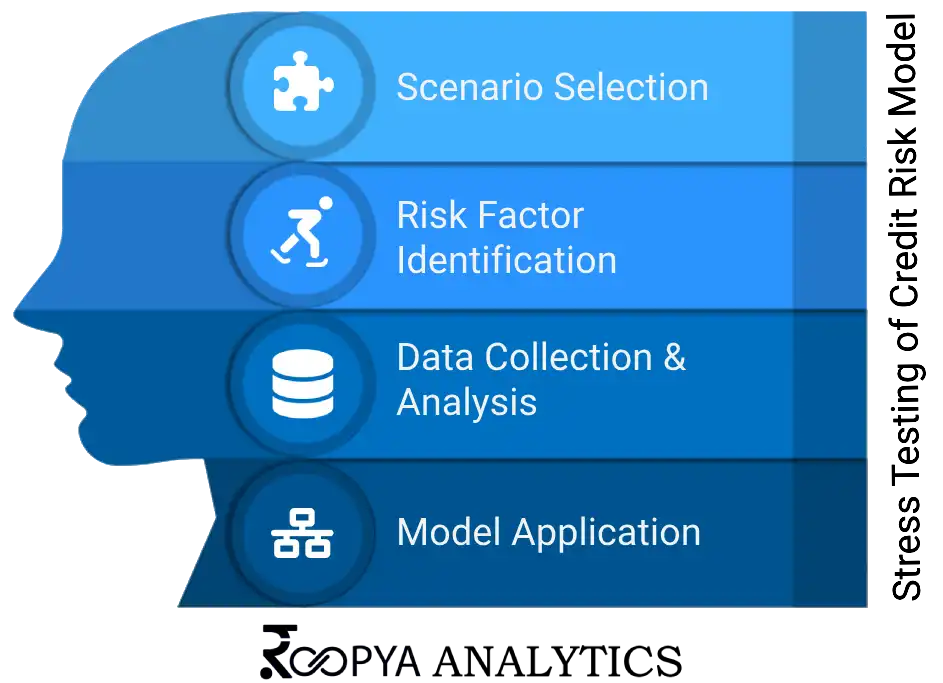

| Scenario Selection |

Detailed design of adverse economic scenarios involving key variables like GDP contraction, inflation spikes, interest rate hikes, and unemployment surges. Each scenario is tailored to test the resilience of the loan portfolio against specific types of financial stress, with a distinction made between scenarios more likely to affect retail borrowers (e.g., unemployment surge) versus those impacting commercial borrowers (e.g., commodity price shocks).

|

IFRS 9 requires entities to use forward-looking information in estimating expected credit losses (ECL), mandating the consideration of macroeconomic variables and their potential future changes.

|

Basel III stresses the importance of a wide range of stress scenarios in capital adequacy and risk management processes, including those that affect market liquidity, interest rates, and sector-specific shocks.

|

| Risk Factor Identification |

In-depth analysis to identify and quantify the sensitivity of loan portfolios to specific risk factors. This involves regression analyses and sensitivity testing to link changes in economic indicators with potential impacts on borrower default rates. Different risk factors are considered for retail (e.g., household income variability, property market fluctuations) versus commercial loans (e.g., business cash flow stability, sector-specific risks).

|

As part of IFRS 9's expected credit loss modelling, risk factors are identified and their impact on credit risk and loss projections are quantified, considering historical, current, and forecasted information.

|

Basel norms detail the need for identifying a broad spectrum of risk factors, including credit, market, operational, and liquidity risks, and how these factors interact under stressed conditions.

|

| Data Collection & Analysis |

This entails aggregating and processing a vast array of data points, including loan performance data, borrower financial statements, industry-specific trends, and macroeconomic data. Advanced statistical and machine learning techniques are utilized to mine this data for insights into the correlation and causation between risk factors and loan defaults, with separate models often developed for retail and commercial portfolios due to their differing risk profiles.

|

Under IFRS 9, significant emphasis is placed on the collection and analysis of data to accurately estimate ECL. This includes both quantitative and qualitative data, reflecting a broad range of information.

|

The Basel framework requires rigorous data management practices for stress testing, ensuring that data is comprehensive, accurate, and suitable for testing models across various hypothetical stressed conditions.

|

| Model Application |

The technical application involves running simulations using the credit risk models across the designed stress scenarios to predict outcomes. This typically uses Monte Carlo simulations, logistic regression models, or machine learning algorithms to project loan defaults and losses under each stress scenario. The application is bifurcated for retail and commercial portfolios to reflect their unique risk characteristics and borrower behaviours.

|

IFRS 9's guideline for model application involves simulating expected credit losses across various scenarios, requiring models to be dynamic and capable of incorporating changes in economic conditions.

|

Basel III guidelines emphasize the use of sophisticated models that can simulate a range of outcomes under stress conditions, assessing the capital adequacy and resilience of banks to withstand financial shocks.

|